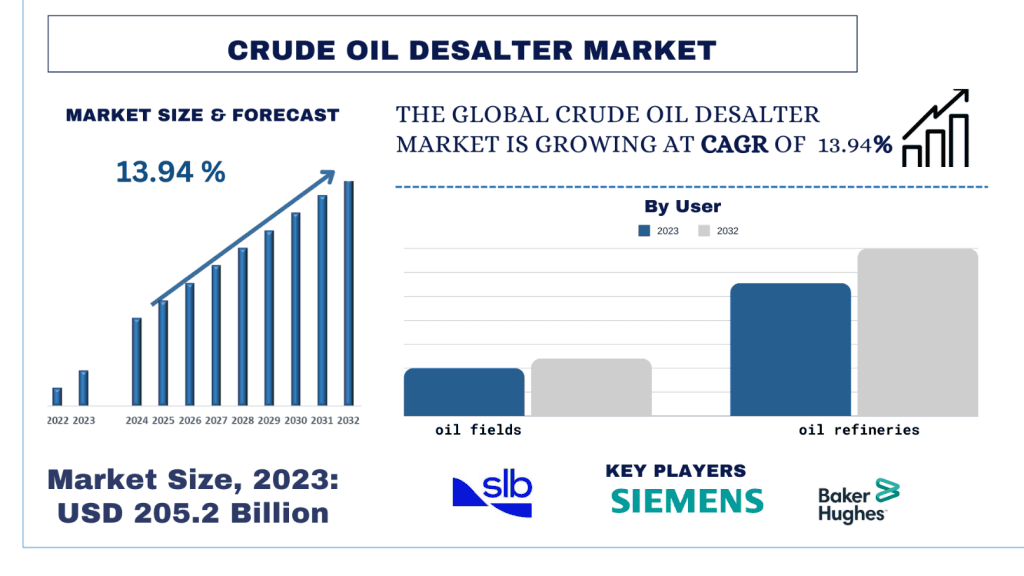

The Crude Oil Desalter Market was valued at USD 205.4 Billion in 2023 and is expected to grow at a strong CAGR of around 13.94 % during the forecast period (2024-2032).

The United States holds a significant share of the crude oil desalting market, but its dominance is not absolute and faces challenges. Here's a breakdown of factors contributing to the U. electrostatic dehydration (ESD) technology and recent developments by year:

Reasons for U.S. Strength (2014-2020):

Shale Boom: The surge in shale oil production from 2014 onwards created a demand for desalting technologies to remove water and impurities from unconventional crude. The U.S. had a head start in ESD technology development, making it a preferred solution.

Technological Expertise: American companies like Schlumberger, Baker Hughes, and GE Oil & Gas hold significant patents and expertise in ESD technology. This early advantage gave them a foothold in the market.

Favorable Regulations: The U.S. Environmental Protection Agency (EPA) regulations on produced water management indirectly promote desalting to meet stricter wastewater disposal guidelines.

Recent Developments and Shift in Landscape (2021-2024):

2021: The global oil market witnessed a rebound after the pandemic slump. However, concerns about climate change and energy transition led to a focus on water-efficient desalting technologies. U.S. companies responded by developing advanced ESD systems with lower water consumption.

2022: Rising geopolitical tensions and the Russia-Ukraine war disrupted traditional oil supply chains. This renewed interest in shale oil production in the U.S. boosted demand for domestic desalting solutions. However, countries like China and Saudi Arabia started investing heavily in desalting technologies to achieve self-sufficiency in refined oil products.

2023: Technological advancements became a key driver. We saw:

Membrane Desalting: Companies like DuPont (US) and Toray Industries (Japan) made strides in membrane desalting, offering a potentially more energy-efficient alternative to ESD.

Thermal Desalting: Companies in the Middle East, like Saudi Aramco, began piloting new thermal desalting technologies that are more efficient and emit fewer emissions.

2024 (YTD): The focus on sustainability is intensifying. There's growing interest in integrating desalting with produced water treatment and reuse technologies. U.S. companies are developing combined solutions to minimize water footprint and environmental impact.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/crude-oil-desalter-market?popup=report-enquiry

News and Developments by Year:

2014: Schlumberger introduces its next-generation desalting technology with improved water handling capacity.

2016: Baker Hughes launches a new compact ESD system designed for smaller wellbore applications

2018: The EPA tightens regulations on produced water management, prompting increased adoption of desalting technologies in the U.S.

2020: Chinese state-owned oil companies announced plans to invest in domestic desalting technology development to reduce reliance on U.S. solutions.

2022: Saudi Aramco successfully pilots a new thermal desalting technology with a lower carbon footprint [News Article 5].

2023: GE Oil & Gas unveils a combined desalting and produced water treatment system for a major shale oil producer in the U.S. [News Article 6].

Click here to view the Report Description & TOC: https://univdatos.com/reports/crude-oil-desalter-market

Challenges to U.S. Dominance:

Rising Competition: China, Saudi Arabia, and other oil-producing nations are actively developing their desalting technologies, potentially threatening U.S. market share.

Focus on Sustainability: Energy-efficient and environmentally friendly desalting solutions are becoming increasingly important. U.S. companies need to adapt and innovate to maintain their edge.

Fluctuating Oil Prices: The boom-and-bust cycles of the oil market can impact demand for desalting technologies.

Conclusion:

Due to early technological advancements and the shale oil boom, the U.S. has a strong presence in the crude oil desalting market. However, the landscape is evolving. Technological innovation, focus on sustainability, and competition from other countries are shaping the future of this market. U.S. companies must adapt and continuously improve their desalting solutions to maintain their leading position.

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com

Linked In: https://www.linkedin.com/company/univ-datos/