Market Estimation & Definition

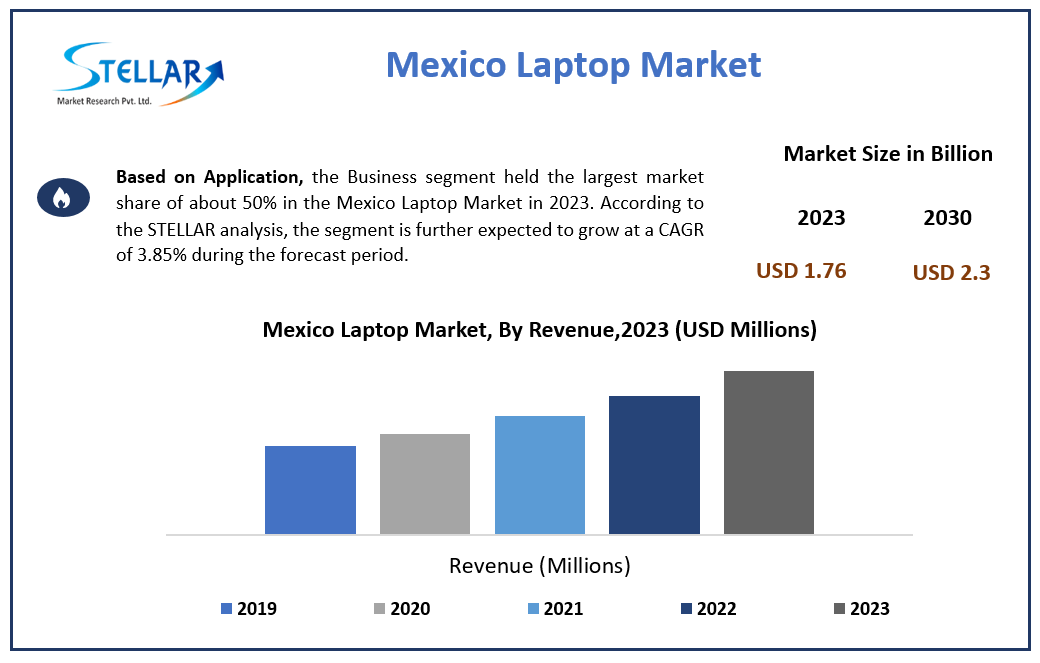

The Mexico laptop market refers to the market for portable personal computers (laptops) purchased and used in Mexico—covering traditional laptops and convertible/2-in-1 models, and spanning applications such as personal use, gaming, business use and education. According to the report, the Mexico laptop market was valued at approximately USD 1.76 billion in 2023, and is expected to grow at a compound annual growth rate (CAGR) of around 3.84% from 2024 to 2030, reaching nearly USD 2.30 billion by 2030.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Mexico-Laptop-Market/2114

Market Growth Drivers & Opportunity

Several key growth factors are supporting this modest yet steady growth trajectory:

-

Increasing demand for mobile computing: The report highlights that remote work, online learning and increasing internet access are driving laptop purchases in Mexico.

-

Growing affordability and disposable income: As incomes rise and laptop prices decline or offer better value, more users in Mexico can afford laptops for both work and personal use.

-

Hybrid work and learning models: The shift to hybrid or remote work and digital education formats has increased the importance of laptops as essential devices for business and education segments.

-

Product innovation and form-factor convergence: Laptops increasingly combine functionality (e.g., touchscreens, detachable keyboards, 2-in-1 form factors) and this appeals to Mexican users seeking flexible computing devices.

Opportunities lie particularly in segments such as business laptops (especially given the large business segment share), 2-in-1 laptops, and value-for-money models tailored to Mexico’s consumer income profile.

What Lies Ahead: Emerging Trends Shaping the Future

Looking ahead, the report identifies several trends that will shape the Mexico laptop market:

-

Dominance of business segment: In 2023, the business application segment held approximately 50% share of the Mexico laptop market. The report forecasts this segment to continue growing at a CAGR of about 3.85% during the forecast period.

-

2-in-1 laptops gaining traction: The segmentation by type includes traditional laptops and 2-in-1 laptops. As more users desire flexibility, the convertible format is expected to pick up share.

-

Affordability-led models and emerging user groups: With increasing internet penetration and younger demographics in Mexico, demand from personal/lower-price tiers (students, first-time buyers) will expand.

-

After-sales, servicing and value-added features: As the market matures, users will expect improved battery life, connectivity, local service support, and brand warranties, creating differentiation opportunities.

-

Headwinds: economic volatility and component costs: The report mentions that economic instability and battery life remain key restraints for the Mexico laptop market.

Segmentation Analysis

According to the report, the Mexico laptop market is segmented in key ways:

-

By Type: Traditional Laptop and 2-in-1 Laptop.

-

By Application: Personal, Gaming and Business. In 2023, Business had about 50 % share and is projected to grow at ~3.85 % CAGR.

-

By Region/Country: While this report focuses on Mexico, the broader context is North America. Additional segmentation may include screen size, price band and distribution channel though the summary highlights type and application most prominently

These segmentation insights help manufacturers and channel partners prioritise business-use laptops (which dominate) alongside emerging personal and gaming segments in Mexico.

Country-Level Analysis (USA & Germany)

Although the report is specific to Mexico, we can contextualise with comparable market behaviours in other mature markets:

-

United States (USA): As part of North America, the U.S. laptop market is larger and more mature, with a higher base of users, earlier adoption of new form-factors and higher per-capita expenditure, which acts as a benchmark.

-

Germany: As one of Europe’s premier markets, Germany shows how mature infrastructure, strong business demand and high-quality user expectations shape laptop purchases—which Mexico can eventually emulate as incomes and digital infrastructure improve.

By referencing these mature markets, stakeholders in Mexico can see the trajectory of where the market might evolve in terms of premium segments, services and replacement cycles.

Commutator (Consumer/User) Analysis

From the consumer perspective in Mexico—both individual users and organisations—the following observations hold:

-

Users value portability, performance and connectivity—laptops enable productivity for work or study, mobility, and remote connectivity.

-

For business users, reliable battery life, service support, corporate procurement channels and brand assurance are important; given the business segment holds about half the market.

-

For personal users (including students), affordability, form factor (2-in-1 vs standard), brand availability and local servicing matter. Growth in personal segment will depend on price accessibility and distribution reach.

-

Gaming users are a smaller, but potentially growing niche—demand for higher-spec machines (graphics, display, performance) may rise among younger, affluent users in Mexico.

-

Retail channels and e-commerce impact purchase decisions: availability of discounts, financing, and local distribution will influence adoption.

Overall, manufacturers and retailers should tailor offerings—entry-level models for personal use, mid-/high-spec for business and gaming, servicing networks, financing and localised features (language, warranty, support) to meet Mexican user expectations.

Press Release Conclusion

In conclusion, the Mexico laptop market is on a stable growth path: valued at approximately USD 1.76 billion in 2023 and projected to reach about USD 2.30 billion by 2030 (CAGR ~3.84%). The market is driven by rising demand for mobile computing, hybrid work and learning, increasing affordability and feature-rich form-factors (including 2-in-1 laptops). With segmentation revealing business applications dominating ~50 % share and the 2-in-1 format emerging, the strategic focus is clear. While mature markets such as the U.S. and Germany offer benchmarks in scale, maturity and premiumisation, Mexico presents opportunities in both business and rising personal segments. For manufacturers, channel partners and service providers, the path ahead lies in aligning product portfolios, distribution (including e-commerce), value pricing, servicing and localised features to Mexican user needs. As digitalisation expands and users become more demanding, the Mexico laptop market offers an incremental yet meaningful growth frontier in the broader North American context.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com