The Electronic Manufacturing Services (EMS) industry, the backbone of modern technology, is experiencing a transformative phase driven by geopolitical shifts and technological demands. Companies are expanding globally, embracing advanced technologies like AI, and adapting to new supply chain realities to serve sectors from AI servers to electric vehicles. This strategic evolution is fueling steady, significant growth as these behind-the-scenes partners become more critical than ever.

The Foundation of a Connected World

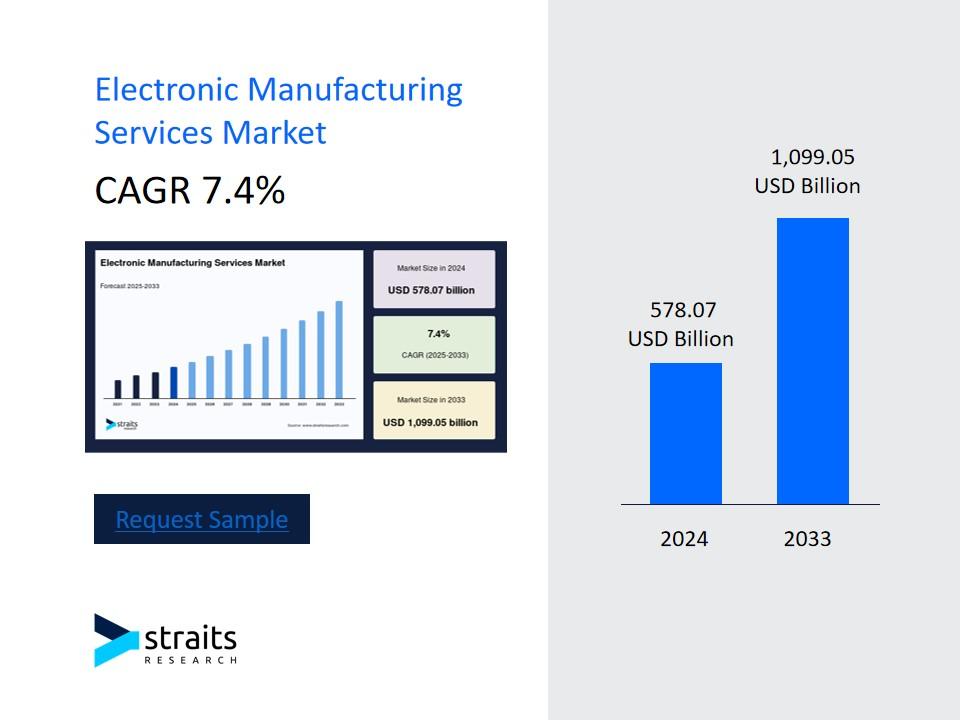

From the smartphone in your pocket to the life-saving equipment in a hospital, nearly every electronic device we interact with is touched by the Electronic Manufacturing Services industry. These companies are the essential partners for iconic brands, handling the complex tasks of manufacturing, testing, and distributing electronics on a global scale. The sector's health is a direct barometer of technological adoption worldwide. According to Straits Research, the global electronic manufacturing services size was valued at USD 578.07 billion in 2024 and is expected to grow from USD 620.85 billion in 2025 to reach USD 1099.05 billion by 2033, growing at a CAGR of 7.4% during the forecast period (2025-2033). This robust growth underscores the industry's pivotal role in an increasingly digital economy.

Key Players and Strategic Global Moves

The EMS landscape is dominated by a few giants, but the strategies they are employing vary significantly based on geography and client needs.

-

North America: Focusing on High-Mix, Low-Volume and Nearshoring

-

Jabil Inc. (USA): Recently, Jabil announced a strategic expansion of its cleanroom and specialized manufacturing facilities in the United States. This move is targeted at serving the booming sectors of healthcare diagnostics and aerospace/defense, where precision and regulatory compliance are paramount. Their latest financial earnings highlighted strong growth in their 5G and cloud infrastructure divisions, catering to the demand for AI data centers.

-

Flex Ltd. (USA/Singapore): Flex is making headlines with its "Agile & Resilient" supply chain initiative. A key update involves establishing smaller, more flexible manufacturing hubs in Eastern Europe and Mexico to serve European and American clients seeking to reduce dependency on transcontinental logistics. They are also investing heavily in their "Sketch-to-Scale" model, providing more design and engineering services upfront.

-

-

Asia: Consolidating Dominance and Moving Up the Value Chain

-

Foxconn (Hon Hai Precision Industry Co., Ltd., Taiwan): The world's largest EMS provider continues to expand its footprint beyond consumer electronics. Recent news includes a major foray into electric vehicle (EV) manufacturing, with new plants under development in Thailand and the United States. Foxconn is also heavily investing in semiconductor fabrication capabilities, aiming to control a more significant portion of the supply chain for its key clients.

-

Wistron Corp. (Taiwan): Following the sale of its iPhone manufacturing业务 in India to the Tata Group, Wistron is strategically pivoting towards higher-margin ventures. The company is now focusing on servers, IT networking equipment, and medical devices. Their recent investor call emphasized a goal to significantly increase revenue from these non-consumer segments over the next three years.

-

-

Europe: Embracing Sustainability and Specialization

-

Benchmark Electronics (USA, with significant EU operations): Benchmark is capitalizing on the demand for complex, reliable products in the aerospace, defense, and medical sectors. A recent update involved the acquisition of a specialized firm in Germany that provides critical circuit card assembly for industrial automation, deepening their expertise in the region.

-

Kimball Electronics Inc. (USA, strong EU presence): Kimball is differentiating itself through a strong emphasis on sustainability. They recently published a detailed report outlining their progress towards using 100% renewable energy in their European facilities and are working closely with automotive clients to manufacture components for electric vehicles, a sector with stringent environmental goals.

-

Dominant Trends Reshaping the Industry

The current strategies of EMS providers are being shaped by several powerful trends:

-

Geographical Diversification ("China Plus One"): The pandemic and geopolitical tensions exposed the risks of concentrated manufacturing. Clients are now actively seeking a "China Plus One" strategy, pushing EMS providers to establish and scale operations in countries like Vietnam, India, Mexico, and Thailand to ensure supply chain resilience.

-

The Rise of Advanced Technologies: The industry is no longer just about assembly. Providers are integrating Artificial Intelligence (AI) and machine learning for predictive quality control and optimizing production lines. There is also a growing focus on manufacturing services for new technologies themselves, including AI servers, EV power systems, and IoT devices.

-

Supply Chain as a Service: Leading EMS players are now offering sophisticated supply chain management as a core part of their value proposition. This includes managing component sourcing, inventory forecasting, and logistics in volatile global conditions, providing clients with much-needed stability.

-

Collaborative Design (JDM/ODM): The line between manufacturing and design is blurring. Many providers are moving beyond simple contract manufacturing (CM) to Joint Design Manufacturing (JDM) and Original Design Manufacturing (ODM), where they partner with clients to co-create products, speeding up time-to-market.

The Invisible Force Driving the Future

The Electronic Manufacturing Services industry operates largely out of sight, but its impact is felt everywhere. As the world becomes more interconnected and reliant on smart technology, the role of these companies will only expand. They are no longer just executors of blueprints but strategic partners enabling innovation, managing global risk, and building the physical infrastructure of the digital age. The steady growth projected for the sector is a testament to its evolving, indispensable role in bringing the next generation of technological breakthroughs to life.